What’s a Buyer Broker Agreement, And What Should You Know Before Signing One?

In the past, a simple handshake could solidify a working agreement between a buyer and their real estate agent. Today, however, buyer's agents present homebuyers with a "buyer broker agreement," a document that formalizes this relationship. If you're new to home buying, the buyer-broker agreement is just one of many documents you'll encounter. For those who purchased homes before the 1990s, this document may seem unfamiliar. Let's break down its importance and the role of a buyer’s agent. The Role of a Buyer’s Agent A buyer’s agent is a real estate professional dedicated to assisting you throughout the home buying process. They have a fiduciary responsibility to ensure you understand the contract language, choose the right contingencies, and avoid being taken advantage of. They also help determine if the home is worth the asking price and assist in making offers. What is a Buyer-Broker Agreement? A buyer-broker agreement is a legally binding document that protects both the buyer and the buyer’s agent. It outlines the agent's duties, the terms of the agreement, and how the agent will be compensated. There are different types of buyer-broker agreements, each with specific terms: Exclusive Right-to-Represent Contracts: The most common type, where you agree to work exclusively with one agent for a specified period. You may be responsible for the agent's commission, although sellers often cover this. Nonexclusive Not-for-Compensation Contracts: These can be terminated at any time and allow you to work with multiple agents without owing compensation. Nonexclusive Right-to-Represent Contracts: These state that you will compensate the agent if the seller doesn't, but you can still work with other agents for properties they haven't shown you. Key Components of a Buyer-Broker Agreement Duties: Specifies the responsibilities of your agent, including showing properties, explaining documents, helping with offers, monitoring contingencies, and supporting you on closing day. Term Length: Defines how long the agreement lasts, typically six months but can vary. This is a negotiable term. Termination: Outlines how either party can terminate the agreement and any required notice or fees. Compensation: Details any retainer fees and the commission structure. The seller usually pays the agent's commission, but in some cases, you may be responsible. Representation: Clarifies the type of representation, whether designated or dual agency. Dual agency, where the agent represents both buyer and seller, is not legal in all states. Exclusivity: States whether you will work exclusively with one agent or have the flexibility to work with others. Property Description: Defines the type of property and price range you're seeking, potentially allowing you to work with another agent for different property types. Conclusion Understanding the buyer-broker agreement is crucial for a smooth home-buying experience. This document ensures that both you and your agent are clear on each other's roles and responsibilities, providing a structured framework for a successful partnership.

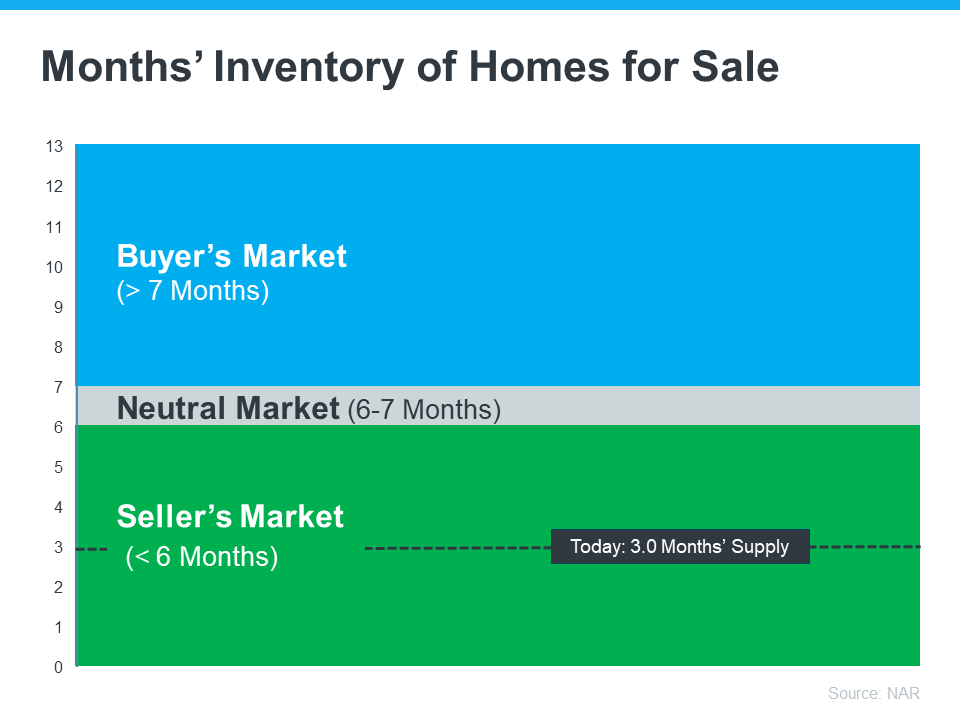

Why Today’s Seller’s Market Is Good for Your Bottom Line

Thinking about selling your house and wondering if now’s a good time to do it? Here’s what you need to know. Even though the number of homes for sale has been growing this year, there still aren’t enough homes on the market for all the buyers who want to buy. So, what does that mean for you? To keep it simple, it means it’s still a seller’s market. Here’s how it works: A neutral market is when supply and demand is balanced. Basically, there are enough homes to meet buyer demand based on the current sales pace, and home prices hold fairly steady. A buyer’s market is when there are more homes for sale than there are buyers. When that happens, buyers have more negotiation power because sellers are willing to make compromises to close the deal. In a buyer’s market, sellers may have to do price cuts to re-ignite interest in their home, and prices may go down. But we haven’t seen this for years since there are so few homes available to buy. In a seller’s market, it’s just the opposite. When the supply of homes for sale is as low as it is right now, it’s much harder for buyers to find homes to purchase. That creates increased competition among purchasers which can lead to more bidding wars. And if buyers know they may be entering a bidding war, they’re going to do their best to submit a very attractive offer upfront. This could drive the final sale price of your house up. The graph below uses data from the National Association of Realtors to show just how deep into seller’s market territory we still are today: What Does This Mean for You? The market is still working in your favor. If you lean on an agent for advice on how to get your house list ready and how to price it competitively, it should get a lot of attention from eager buyers. That means you’ll likely get multiple offers and see your house sell quickly and for top dollar. As a recent article from Ramsey Solutions explains: “A seller’s market is when demand for homes is higher than the supply of homes. And that’s still the case right now. If you’re planning to sell your house, you can expect to sell it fairly quickly for close to your asking price—as long as your asking price is realistic for the current market.”

Four Ways You Can Use Your Home Equity

If you’re a homeowner, odds are your equity has grown significantly over the last few years. Equity builds over time as home values grow and as you pay down your home loan. And, since home prices skyrocketed during the ‘unicorn’ years, you’ve likely gained more than you think. According to the latest Equity Insights Report from CoreLogic, the average homeowner has more than $274,000 in equity right now. That much equity can help you achieve certain goals. In a recent article, Bankrate elaborates: “While the pandemic created serious challenges, the silver lining for anyone who owned a home was the sizable equity gain. Understanding how home equity works, and how to leverage it, is important for any homeowner.” Here are a few examples of how you can put your home equity to work for you. 1. Buy a Home That Fits Your Needs If your current space no longer meets your needs, it might be time to think about moving to a bigger home. And if you've got too much space, downsizing to a smaller home could be just right. Either way, you can put your equity toward a down payment on a home that fits your changing lifestyle. A real estate agent can help you figure out how much equity you've got and how to use it when buying your next home. 2. Reinvest in Your Current Home Renovations are a great option if you want to change your living space, but you aren’t yet ready to make a move. Home improvement projects give you the freedom to tailor your home to match your needs and personal style. But it's important to consider the long-term benefits certain upgrades can bring to your home’s value. Lean on a real estate professional for the best advice on which improvement projects to prioritize in order to get the greatest return on your investment when you sell later on. 3. Pursue Personal Ambitions Home equity can also serve as a catalyst for realizing your life-long dreams. That could mean investing in a new business venture, retirement, or funding an education. While you shouldn’t use your equity for unnecessary spending, using it responsibly for something meaningful and impactful can really make a difference in your life. 4. Understand Your Options to Avoid Foreclosure Today the number of foreclosure filings remains below the norm, so there’s no need to fear a wave of foreclosed homes flooding the market. But unfortunately, there are still some homeowners who experience the foreclosure process each year. If you’re facing financial difficulties, having a clear understanding of your options and how your equity can help is crucial. Equity can act as a financial cushion that can be used in times of unexpected challenges or unforeseen circumstances that may disrupt your ability to make mortgage payments on time. In an article, Freddie Mac explains it this way: “If exiting your home is the best option for you, selling with equity may be a good option. When selling with equity, you are using the proceeds from selling your home at a higher price than the amount you owe on your mortgage to pay off your remaining mortgage debt.” Bottom Line Your equity can be a game changer in reinvesting in your needs, pursuing your goals, and even helping you avoid foreclosure during difficult times. If you’re unsure how much equity you have in your home, let’s connect so you can start planning your next move.

Categories

Recent Posts