Why Today’s Seller’s Market Is Good for Your Bottom Line

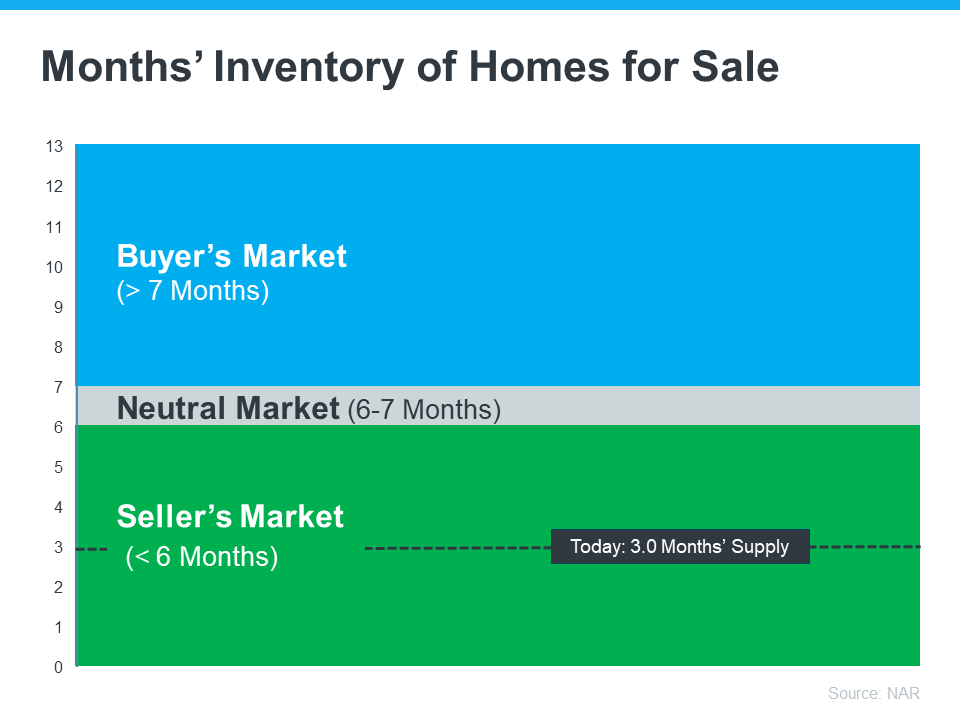

Thinking about selling your house and wondering if now’s a good time to do it? Here’s what you need to know. Even though the number of homes for sale has been growing this year, there still aren’t enough homes on the market for all the buyers who want to buy. So, what does that mean for you? To kee

Four Ways You Can Use Your Home Equity

If you’re a homeowner, odds are your equity has grown significantly over the last few years. Equity builds over time as home values grow and as you pay down your home loan. And, since home prices skyrocketed during the ‘unicorn’ years, you’ve likely gained more than you think. According to the lat

The Short Sale Process: 5 Steps to Break Free of Mortgage Trouble for Good

The short sale process can seem intimidating, yet getting a handle on the steps can make it a lotless scary—and help home sellers navigate a difficult financial situation without too muchdamage. A short sale—where homeowners sell their property for less than they owe on their mortgage—isoften the la

Categories

Recent Posts